The Power of Support and Resistance

- Gautam Mazumdar

- Sep 10, 2025

- 5 min read

In financial markets, where price action reflects a constant tug-of-war between buyers and sellers, few concepts are as fundamental—or as revealing—as support and resistance. These invisible lines, drawn not by any central authority but by collective trader psychology, dictate where trends pause, reverse, or accelerate. For anyone serious about trading, learning to recognise and respect these levels is not optional; it is essential.

In this article, we will explore what support and resistance truly mean, why they work, and how you can integrate them into your trading toolkit. We will also address common misconceptions, practical techniques for identifying zones, and real-world examples that show how markets repeatedly bow to these lines in the sand.

What are Support and Resistance?

At its core, support is a price level where demand outweighs supply. It is the “floor” where falling prices find enough buyers to halt further decline. Conversely, resistance is the “ceiling” where supply exceeds demand, preventing prices from rising further.

Think of these levels as psychological anchors. Traders remember past battles fought at certain prices—whether it was pain from losses or joy from profits—and they act accordingly when price returns to that zone. This collective memory fuels the persistence of support and resistance.

Why Do They Work?

The strength of support and resistance lies in human behaviour:

Anchoring Bias – Investors often fixate on prior price points. If someone bought a stock at ₹500 and it plunged to ₹400, they may vow to exit “once it gets back to ₹500.” That makes ₹500 a resistance level.

Fear and Greed – Buyers rush in at perceived bargain zones (support), while sellers pile in at perceived overvaluation levels (resistance).

Order Clustering – Stop-loss orders and take-profit targets tend to cluster around obvious levels. This concentration magnifies reactions when those levels are tested.

The result? Prices may ricochet between these zones like a ball bouncing between floor and ceiling—until the structure breaks.

The Dynamics of Breakouts and Breakdowns

Support and resistance are not permanent walls; they are zones of temporary control. When broken, they often reverse roles:

Support turned resistance – If a floor is broken, it often acts as a ceiling during the next rally attempt.

Resistance turned support – If a ceiling is breached, it frequently becomes a floor for subsequent pullbacks.

This role reversal is a cornerstone of chart reading. It symbolises how once one side of the market loses control, the other seizes dominance. The transition often sparks trend acceleration, as trapped traders rush to cover positions.

Identifying Key Levels

There are multiple ways to identify meaningful support and resistance:

Swing Highs and Lows – Past turning points on charts often mark zones of interest.

Moving Averages – Widely-followed averages like the 50-day or 200-day often act as dynamic support/resistance.

Round Numbers – Human preference for psychological numbers (₹100, $1,000, Dow 40,000) makes these levels sticky.

Volume Profile – High-volume areas show where heavy trading occurred, reinforcing those price levels.

Trendlines and Channels – Diagonal support and resistance guide traders in trending markets.

Gap Zone - A revisit to gap zone often becomes a support or resistance for the stock

Practical Illustration

Consider a stock that rallied from ₹200 to ₹300 before retreating. The ₹300 level becomes a visible resistance. If price later consolidates around ₹250 and then surges past ₹300, traders who missed the move—or were trapped selling—often fuel the next leg higher, pushing prices to ₹350 or more.

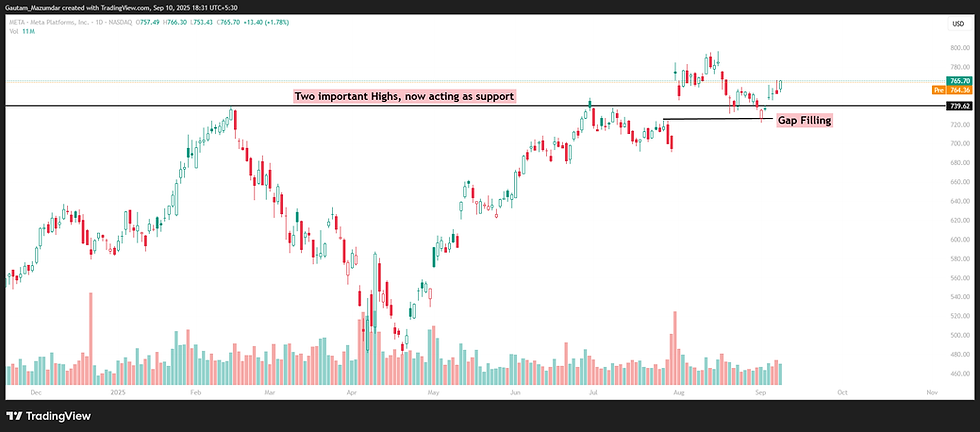

Chart 1. Daily chart of Meta Platforms (META) showing prior highs around $740 turning into support, with a gap-fill retest confirming the strength of the zone.

The Myth of Exactness

A common misconception is that support and resistance are precise numbers. In reality, they function as zones. Price can pierce a level intraday, only to close above or below it, leaving traders who treated it as an exact line frustrated.

Professional traders avoid the trap of exactness by giving buffers or “zones” of a few percentage points or ticks. This reduces false signals and aligns with how institutions, whose large orders shape markets, operate within ranges rather than at a single price.

False Breakouts: Friend or Foe?

Markets love deception. A price may briefly break through resistance, luring breakout traders, only to collapse back into the prior range. These false breakouts are not failures—they are opportunities. They reveal where the majority has been trapped and where the next directional move might unfold.

The key lies in confirmation. Waiting for follow-through—such as strong volume, a decisive close, or a retest—can filter noise from genuine breakouts.

Support and Resistance in Different Market Conditions

Trending Markets – Support and resistance act as staircases, guiding the trend step by step.

Range-Bound Markets – Prices oscillate between well-defined levels, creating opportunities for swing traders.

Volatile Markets – Levels may be tested and broken frequently, demanding flexibility and risk control.

Integrating with Other Tools

Support and resistance do not exist in isolation. Their power increases when confirmed by other indicators:

Volume – High volume at a level reinforces its credibility.

Momentum Indicators – Tools like RSI or MACD can highlight exhaustion near resistance or strength near support.

Candlestick Patterns – Reversal candles (hammer, shooting star) at these levels provide early signals.

By blending these approaches, traders build a more robust framework for decision-making.

Risk Management Around Key Levels

Support and resistance are not just predictive tools; they are essential for risk management:

Stop-Loss Placement – Logical stops are set just beyond key levels.

Target Setting – Resistance zones often serve as profit-taking targets.

Position Sizing – The width of a support/resistance zone helps calculate risk per trade.

In short, these levels guide not only entries but also exits and capital preservation.

Common Mistakes to Avoid

Treating levels as absolute prices instead of flexible zones.

Ignoring higher timeframes—a daily support may crumble under the weight of weekly resistance.

Overloading charts with too many lines, leading to paralysis.

Forgetting that markets evolve—yesterday’s critical level may lose relevance as new battles are fought.

Conclusion

Support and resistance are the grammar of price action. Without them, charts are a jumble of candles and lines. With them, they transform into structured narratives—revealing who is in control, where battles are fought, and where the next chapter may unfold.

As you refine your trading journey, do not treat support and resistance as static drawings. See them as living reflections of trader psychology. They embody memory, fear, greed, and expectation—all converging into levels where markets pause, reverse, or explode. Respect them, and you will decode one of the market’s oldest but most enduring secrets.

Gautam Mazumdar

Chart Decoder

Comments